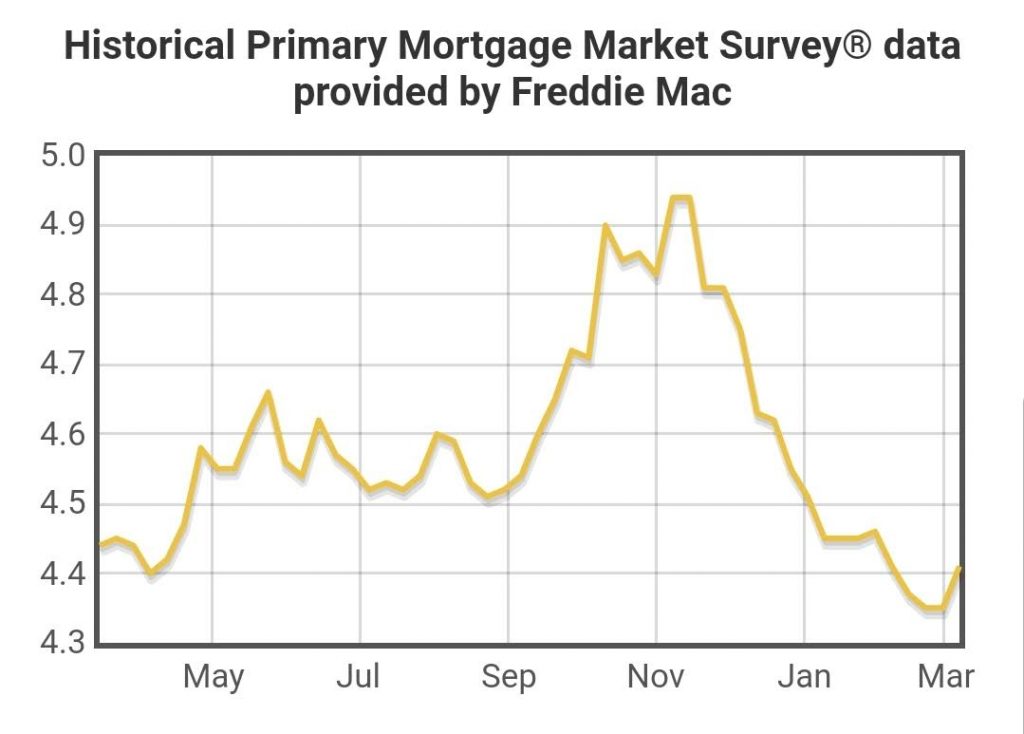

As of 3/11/19 mortgage interest rates did tick up a little recently, but are still low (slightly under 4.5%) compared to December’s high (almost 5%) (see chart below). The important thing to note is that the market did react negatively to the rising interest rates in the last quarter of 2018 and did cause a decrease in sales which has minor ripple effects still seen now in March. For sellers, this means you should take advantage of the low rates because another steady incline could impact how much your home could sell for and how fast your property could sell. For buyers, you need to take advantage of the rates now as most factors are pointing to an increase in the near future.

There are multiple factors that affect mortgage rates, but the Federal Reserve benchmark and 10-year treasury bonds seem to be major factors right now, as the economy and real estate market are both favorable for rate increases. The Fed has stated they want to be patient for 2019.

My prediction is that the market is volatile in 2019 for noticeable increases to the mortgage rates. This is due to home prices reaching historic highs, making the last affordability factor mortgage interest rates. 2019 is going to be a year to watch.

See my post on the February 2019 Market Update